It’s hard to overstate just how much technology has changed our lives over the past several decades. These days we take laptops, smartphones, and technology like Wi-Fi, Bluetooth®, and Near-Field Communication (NFC) for granted. So, it should be no surprise that they’ve all created an enormous connected device ecosystem that reached more than 48 billion devices last year.

UWB Use Cases

UWB and the Auto Industry

Over the last few years, new connectivity technologies, such as ultra-wideband (UWB), have entered the market. With them came new use cases and experiences across a wide range of applications. Once such application is secured car access. It has acted as a catalyst for the first major UWB adoption wave since 2020 within the automotive industry with OEM-centric implementations driven by security concerns of passive keyless entry systems. In parallel, it’s been widely implemented by the mobile device industry and has been standardized since then by the Car Connectivity Consortium (CCC) and its various members. (In November 2023, FiRa® Consortium and the CCC announced a joint working group.)

UWB is a natural choice for secured car access. Learn more about it here.

While various car platforms used UWB technology on top of sub 1GHz car access solutions using key fobs for a few years, many new vehicles already include UWB technology such as the BMW 7, iX and iX1, X1, XM, i4, and i7 series, Genesis GV60, the Kia EV9, the Mercedes-Benz E-Class, and Volvo EX30. They are already including UWB technology-based on the CCC specification. UWB-equipped iOS and Android smartphones from various vendors support these digital car keys. By 2028, nearly a third of vehicles shipped are expected to be equipped using UWB as secure access technology.

Vehicle access is only the beginning. On the near horizon are applications for UWB within vehicles including automatic valet parking payment, Child Presence Detection (CPD) systems, intrusion alerts, and car-as-a-key which opens a garage when a vehicle approaches.

UWB at Home

UWB-enabled smartphones are also capable of locating items such as keys, wallets, backpacks, luggage, and other personal items, thanks to UWB personal tracker tags. In 2021, Apple unveiled its AirTag solution and Samsung officially launched its Galaxy SmartTag+ tracker. Learn more about how this technology works in our FiRa Presents video Find Someone/Something. Additionally, this will soon allow us to find a car inside the parking garage. Due to the capability of exact positioning, this technology can be used for several convenience features like a welcome light while a driver is approaching the car in the garage.

Other UWB use cases focus on creating more seamless, automated, and personalized experiences within the home. This includes UWB-enabled smartphones that can interact with other UWB-enabled connected home devices like speakers, TVs, light bulbs, thermostats, or other smart appliances like fans. Using UWB’s high accuracy and direction capabilities, smartphones will soon be able to detect exactly what device is being pointed at and automatically open up a relevant control panel on the smartphone. Get more information with FiRa’s Point-and-Trigger Control use case leaflet.

UWB Growth

While a number of use cases and devices have already been investigated and developed, UWB is still a new technology. As its adoption continues to grow, so will its potential and innovations.

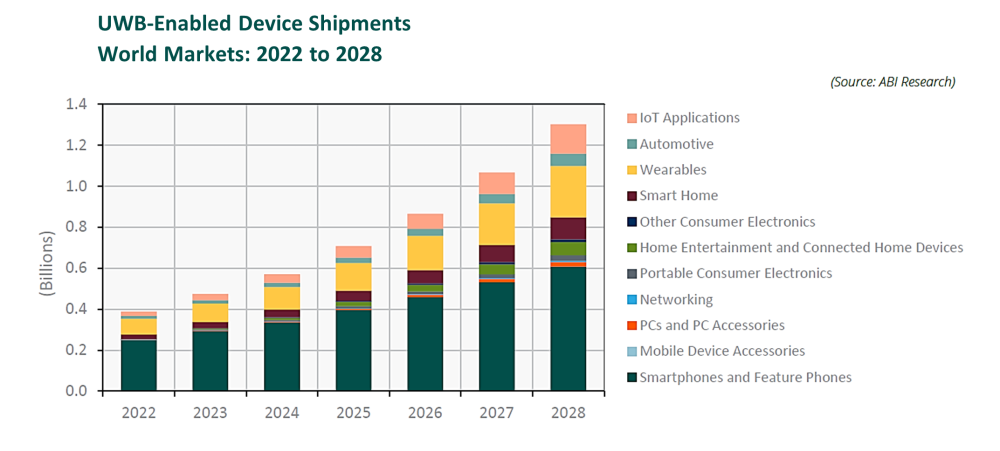

UWB is forecasted to grow this year from 435 million UWB-enabled device shipments in 2023 to an estimated 531 million shipments in 2024. By 2028, that number will increase to 1.3 billion shipments. The drivers behind this growth will continue to be smartphones and wearables, as well as rapid advancements in consumer, automotive, Internet of Things (IoT), and Real-Time Location System (RTLS) markets.

UWB’s ecosystem growth will depend significantly on the rollout of UWB technology within smartphone devices. In 2022, 21% of smartphone shipments included UWB technology, including Apple’s iPhone 11 to 14, Samsung’s Galaxy (+and Ultra models) S21, S22, and S23, Z Fold 2, 3, and 4, Google’s Pixel 6 Pro, 7 Pro, and Fold, and Xiaomi’s Mi MIX 4.

According to ABI Research, nearly half of the smartphones shipped will include UWB technology over the next four years. UWB-enabled Apple Watches, from the Series 6 onward, has also propelled the smartwatch market to become one of the biggest markets for UWB adoption to date. Integration of UWB in smartphones and wearables will be vital in driving further UWB adoption.

What’s Next for UWB?

As it expands into new applications and devices, UWB is poised to revolutionize how we interact with technology. Secure car access and seamless smart home experiences are just the beginning. Some of FiRa’s use cases this year include Asset Tracking, Tap-Free Mobile Payment, and Pubic Transport Fare Collection.

With this ongoing progress in adoption, UWB technology could soon become the global standard. It looks like UWB is here to stay.