Executive Summary

1.1 Introduction to Ultra-Wideband (UWB) Technology

Ultra-wideband (UWB) is a short-range, wireless technology that makes use of wideband radio waves. UWB is allowed to operate in higher frequency bands and uses a wider bandwidth (500 megahertz or more) than Wi-Fi or Bluetooth®. These special characteristics of UWB make it more accurate when it comes to positioning capabilities and it also provides a higher level of security for ranging applications.

1.2 Demand for UWB is Steadily Growing

UWB is being adopted in flagship smartphones to enable secure access and context-based user interfaces. In 2021, UWB was installed in over 300 million smartphones, representing an attach rate of approximately 20%. It is anticipated that in the next five (5) to ten (10) years, UWB will gradually be adopted across all smartphones, representing a market potential of 1.5 billion UWB-enabled devices per year.

1.3 Social and Economic Impact

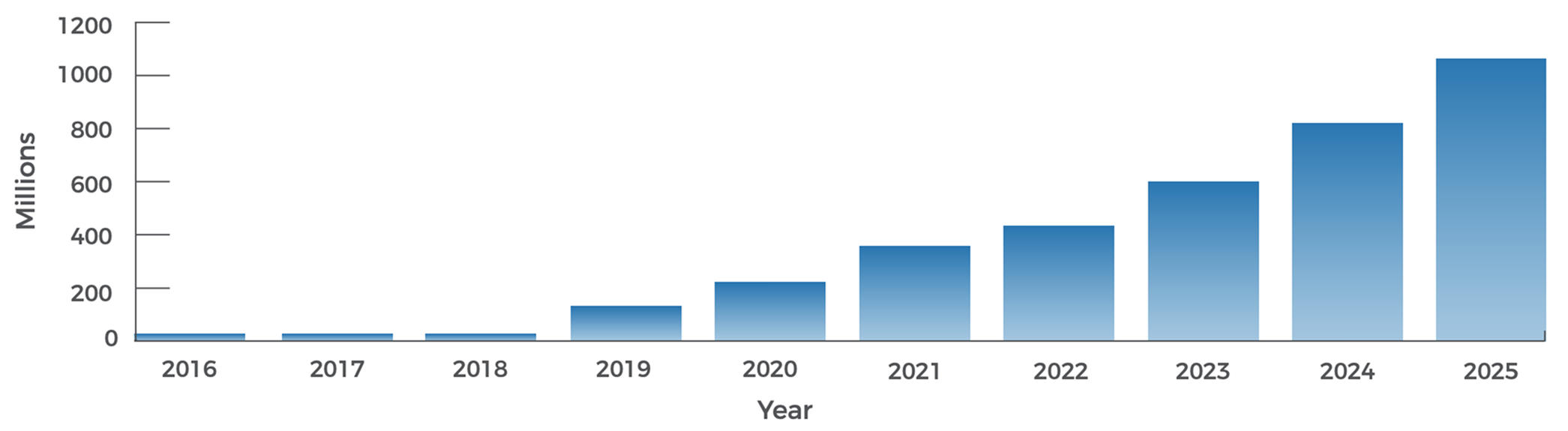

According to ABI Research, the number of UWB-enabled devices shipped globally is poised to grow from 109 million devices in 2019 to over 1 billion devices by 20251. In total, 3.6 billion UWB-enabled devices will be shipped globally by 2025. In fact, the UWB market is projected to grow by double digit percentages for the foreseeable future.

The other segments driving growth of UWB are Internet of Things (IoT) and Real-Time Location Systems (RTLS).

According to Verified Market Research, “the IoT market size was valued at USD 1186.20 Million in 2021 and is

projected to reach USD 6075.70 Million by 2030, growing at a CAGR of 19.91% from 2022 to 2030.”2. Forecasts from

MarketsandMarketsTM project an even stronger growth for the RTLS global indoor location market, indicating that

this market will grow from approximately $7 billion this year to $19.7 billion by 2026, a CAGR of nearly 23%.

1.4 Regulatory Enhancements – Responding to Demand

The FiRaTM Consortium (www.firaconsortium.org) believes that changes in the current FCC regulations regarding the use of UWB technology will improve the capabilities of devices and drive growth in the number of UWB-enabled products that are FCC approved.

The current regulations were developed over twenty years ago; at that time, the current capabilities of UWB were not and could not have been contemplated. For this reason, the current regulations have shortcomings that have been highlighted when working with UWB technology in modern, real-world use cases.

The original rules from 2002 envisioned the use of UWB for high and ultra-high bandwidth data communications using OFDM modulation. However, today, UWB technology is more commonly used for ranging and localization applications, with impulse-based modulation and low activity factors. Current FCC rules do not permit fixed position outdoor UWB stations, even though the potential harmful interference from these devices is extremely low. This restriction negatively affects use cases such as door locks and significantly hampers the rollout of seamless access control and RTLS applications.

Examples of regulatory changes that would further accelerate the adoption of UWB are:

- Allow fixed outdoor operation for precise location and device control applications.

- Permit measures more suitable to positioning and ranging applications that avoid unnecessary permanent transmissions.

- Explicitly allow use of UWB in automobiles for digital key, location tracking, and sensing applications, both inside and outside of a vehicle. • Allow higher power indoors for precise location in large spaces.

- Allow additional spectrum in relatively low interference bands above 10 GHz.

- Eliminate a prohibition on UWB use in toys.

- Permit UWB antennas to be mounted separately from the transmitting device, as permitted for other FCC Part 15 devices.

- Designate a safe harbor band for critical UWB services, where shared use is limited to other compatible low-power operations with low duty cycles.

As discussed below, many of these new UWB applications do not fall within the current FCC regulations and therefore requires developers to obtain waivers. Typically, these waivers are narrow in scope and can take several months or even years to work their way through the administrative process.

To allow UWB to reach its full potential and a broader market, regulatory changes would help align regulations with today’s market needs, while maintaining the integrity of the spectrum for full use. The FiRa Consortium asks the FCC to consider these changes and amend the way the regulations are currently written and regulated.

2 Introduction

After decades of discussion and development, ultra-wideband (UWB) technology is now demonstrating its potential to quickly become a vital mainstream wireless technology like Wi-Fi and Bluetooth®. UWB technology outperforms other technologies in terms of ranging accuracy, energy efficiency, cost, and security.

Unlike other wireless technologies, UWB has a very low transmit power that allows it to operate over a wide part of the spectrum and co-exist with other users and wireless technologies without disturbing other uses/ users. This also makes UWB well-suited for high-density applications since such intense use could occur without any significant potential for harmful interference to other communications systems.

Beyond the capabilities of Wi-Fi and Bluetooth, based on its fine-ranging capability offering location accuracy to within a few centimeters, UWB has the ability to change the way in which we experience connectivity and interact with other humans and objects around us. Mainstream uses today include digital car keys (as specified by the Car Connectivity Consortium), the ability to locate objects equipped with an Apple AirTagTM or Samsung Galaxy SmartTag+TM, the ability to “point-and-click” to control devices at home, and indoor location services within commercial and industrial environments. As the technology continues to evolve, the possibilities for use cases relying on UWB are endless!

As referenced in the 2021 FiRa Consortium Annual Report, the UWB market is dynamic and growing rapidly. The marketplace is at an inflection point where a broad set of established companies are designing and building products and services utilizing UWB technology. By way of example:

- According to ABI Research, the number of UWBenabled devices shipped globally will grow from 109 million devices in 2019 to over 1 billion devices by 20254. In total, 3.6 billion UWB-enabled devices will be shipped globally by 2025.

- As evidenced by early adoption of UWB by car manufacturers such as BMW, Hyundai, Jaguar, Land Rover, Mercedes, and Volkswagen, the automotive segment will be a mass adopter of UWB technology. Digital car key is currently supported by Apple, Google, and Samsung smartphones, providing seamless and secure access to cars from smartphones. (Note that vehicle digital key is being standardized by the Car Connectivity Consortium.)

- MarketsandMarketsTM notes that the consumer electronics vertical will hold the largest market share of UWB from 2020 to 20255. There is an increasing demand for UWB technology in consumer electronics based on UWB’s ability to significantly improve the consumer experience related to home entertainment products such as televisions, laptops, and audio equipment.

More information on the growth of the UWB market can be found in Section 6 of this paper.

UWB operates under a regulatory framework that was largely adopted 20 years ago based on known and/or anticipated use cases at that time. During the 20 years since, UWB developers have gained experience, improved UWB technology, and identified different uses for UWB.

These actions have pushed the bounds of current regulations to where the regulations are no longer aligned nor appropriate for the UWB use cases that are of interest today. While regulators have, in several cases, adopted waivers of the regulations to permit new uses, the waiver review and approval process can be slow and narrow in scope, thereby delaying and inhibiting valuable new UWB services. It is time for regulators to consider an updated regulatory framework that recognizes current technology, anticipates future developments, and enables the plethora of capabilities and services that are within the potential of UWB, all while protecting other spectrum uses.

With a new regulatory framework, there are many reasons to expect that UWB will live up to its full potential. It is not one or two entities that seek this advancement, but an entire industry united to work together to bring these capabilities and services to life. As noted in a recent article in the Wall Street Journal6, “membership of the FiRaTM Consortium, a non-profit developing the UWB standard, is a who’s-who of major tech companies”. The article goes on to say that “UWB is not, in other words, some proprietary part of one tech giant’s walled garden. It’s more like a basic piece of consumer (and industrial) communications infrastructure, like Wi-Fi, Bluetooth or 5G cellular standards”.

In this paper we present an overview of UWB technology and how it works. This paper also details how the FiRa Consortium collaborates with industry to grow an open and interoperable ecosystem. We explain the importance of standards and interoperability followed by an overview of a few impactful UWB use cases. In addition, we provide information on the overall UWB market dynamics and growth predicted by industry analysts. We conclude by discussing how current regulatory challenges are impacting the growth of the UWB-enabled ecosystem.

3 UWB Overview

3.1 What is UWB?

Ultra-wideband (UWB) is a short-range, wireless communication protocol like Wi-Fi or Bluetooth that makes use of radio waves. It differs, however, in that UWB is allowed to operate at higher frequency bands and uses a wide spectrum bandwidth (500 megahertz or more). Since UWB devices operate in a spectrum that overlaps with preexisting allocations and uses, UWB devices also operate at very low transmit power limits to prevent interference.

A UWB transmitter works by sending extremely short pulses (UWB was previously known as “impulse radio”) across a wide spectrum channel; a corresponding receiver then translates the pulses into data by listening for a familiar pulse sequence sent by the transmitter.

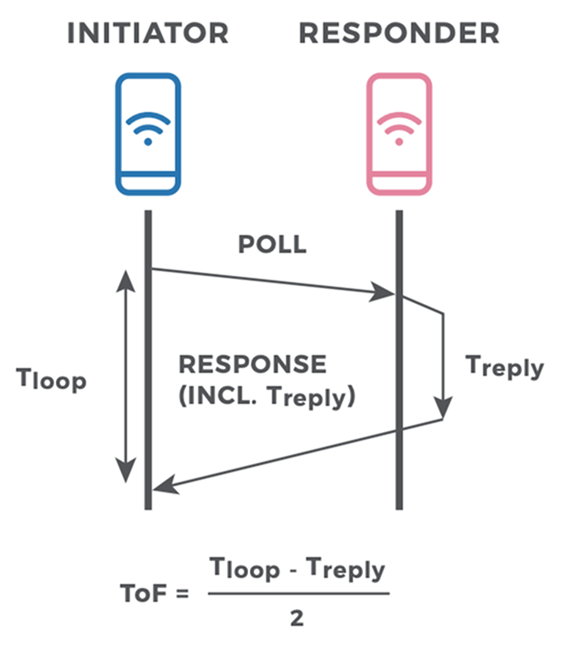

In the current FiRaTM Consortium7 specification, once a UWB-enabled device like a smartphone or smart watch is near another UWB-enabled device, the devices trigger “ranging” using UWB transmissions. Ranging refers to calculating the Time-of-Flight (ToF) between devices (i.e., the roundtrip time of challenge/response packs of data in RF bursts, as shown in Figure 1 below). By using a larger channel bandwidth (500 megahertz or more) with short pulses (of about two nanoseconds each), UWB achieves greater accuracy than any of the other current methods. The UWB positioning process happens virtually instantaneously, tracking the device’s movements in real-time. In doing so, UWB-enabled devices can perceive both motion and relative position.

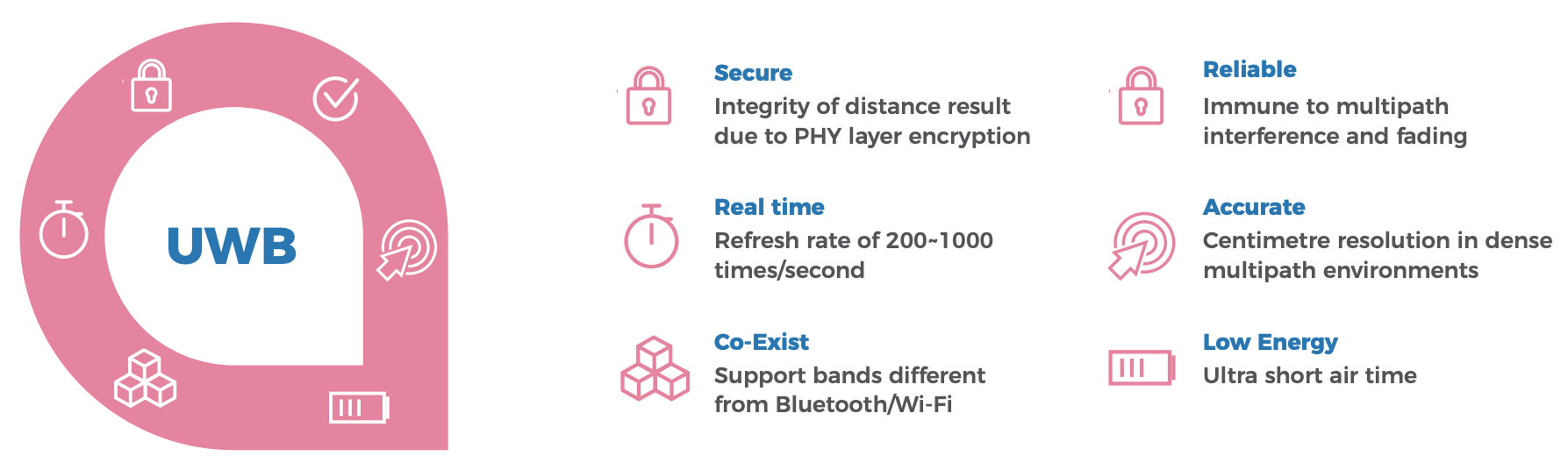

Interest in and commercial use of UWB is growing due to its unique features that include centimeter-level accuracy of positioning and high data transfer rates. For example, Apple, a member of the FiRa Consortium, has publicly stated that UWB technology offers “spatial awareness” which is the ability for your phone to recognize its surroundings and the objects in it. This allows a smartphone user to simply point his or her smartphone at another smartphone to transfer a file or photo.

Use of short pulses allow UWB to measure distance and to determine position much more accurately than other technologies. This also makes it more secure. Furthermore, UWB’s wide bandwidth reduces fading effects, generating constant power at the receiver, therefore making it more robust than Wi-Fi and Bluetooth in multipath environments.

3.2 How UWB Works

The UWB operating concept is simple. Once a device that is equipped with a UWB radio, such as a smartphone, wristband, or smart key, comes into range of another UWB-enabled device, the devices start ranging. The FiRa protocol includes a detection mechanism for UWB devices to detect each other’s presence. The ranging is done by performing Time-of-Flight (ToF) measurements (see Figure 1) between the devices. The ToF is calculated by measuring the roundtrip time of challenge/response packets. Depending on the type of application (e.g., in case of asset tracking, device localization), either the mobile or the fixed UWB device calculates the precise location of the device. In the case where the device is running an indoor navigation service, it is required to know its relative location to the fixed UWB anchors and calculate its position on the area map.

3.3 UWB-Enabled Devices Understand Motion and Relative Position

The real-time accuracy of UWB measurements means a UWB-enabled system can know, with a very high degree of certainty, the precise location of a device and whether it’s stationary or moving toward or away from a given object. For example, a UWBenabled system can sense if you’re moving toward a locked door and it can know if you’re on the inside or outside of the doorway. This allows it to determine if the lock should remain closed or open when you reach a certain point.

The precise accuracy of UWB ranging allows the use case to define the exact intended range to avoid false triggering. For example, if you live in a house with an attached garage, the UWB-enabled system can be configured to detect when your car approaches and open the garage door. Or that it is time to unlock the entryway from the garage to the kitchen so you can bring in your groceries.

3.4 UWB Delivers Higher Security

Today’s technologies for ranging primarily rely on signal strength to determine distance and location. They measure the device’s signal strength and assume a strong signal means the device is close by. Using what is called a relay station attack, attackers have found a way to trick these systems. In this type of attack, the legitimate wireless signals used to unlock a door are intercepted and amplified, causing the door to open even though the key isn’t close by. What’s missing in these other technologies is the precise calculation of actual physical distance; this is exactly what UWB brings to the application. With UWB, any attempt to intercept and amplify the signal during a relay attack will only delay the arrival of the responding device’s acknowledgement signal, making it clear to the UWB-based lock that the responding device is actually further away, not closer. Any UWB signal which attackers succeed in intercepting and boosting won’t trick a UWB-equipped lock into opening. Moreover, the extension of IEEE 802.15.4z adds physical layer (PHY) level protection to all known attacks on legacy UWB radios.

3.5 UWB Technology Comparison

The wireless connectivity technology industry has grown so huge that it can be challenging to put new entrants into perspective. While Wi-Fi and Bluetooth already benefit from very broad market adoption, they lack in accuracy when it comes to their positioning capabilities. When compared to UWB, these technologies provide relatively little to no RF level security to protect ranging.

While it is possible to achieve ranging with other wireless connectivity technologies, you will need to evaluate your environment and determine what accuracy and response time is required for your use case. This will determine the choice of technology.

In differing use cases, each technology has its own strengths. As shown in Figure 2, here are the key advantages UWB has over other positioning technologies:

- When it comes to accurate positioning, UWB stands out thanks to its ability to precisely localize devices and objects down to less than 10 cm in line-of-sight or non-line-of-sight.

- With a refresh rate of ~200-1000 times per second, pinpointing a location is done in real time.

- UWB pulses resist a common difficulty known as the multipath effect. This is what happens when radio signals reach the receiver by more than one path, due to reflection or refraction caused by natural or manmade objects close to the main signal path. The multipath channels cause inter-symbol-interference (ISI) in normal signal transmissions, since signals arriving at the receiver from different paths are destructively combined. As a result, signals are distorted when arriving at a receiver.

However, in the case of UWB, the pulses are very short in time, which significantly minimizes ISI when arriving at a receiver. This is because UWB pulses arriving at different times through multiple paths, are so short in time that they do not interfere with each other. Therefore, the received UWB pulses are still distinguishable at the receiver, giving them resistance to the multipath effect.

- Its immunity to multipath interference and fading makes it a very robust technology option. The high time resolution and short wavelength of UWB signals make it much more resistant to multipath interference and fading

- UWB operates in a different part of the radio spectrum, away from the busy ISM band clustered around 2.4 GHz. The UWB pulses used for location and ranging operate mainly in the frequency range between 6.5 and 9 GHz and don’t interfere with wireless transmissions happening elsewhere in the spectrum. That means UWB co-exists with today’s most popular wireless formats, including satellite navigation, Wi-Fi, Bluetooth, and even Near Field Communication (NFC).

- One of the most important additions to UWB, being defined as part of the new IEEE 802.15.4z specification, is an extra portion of the physical layer (PHY) used to send and receive packets of data. The new feature adds cryptography, random number generation, and other techniques that make it harder for an external attacker to access or manipulate UWB communications.

UWB’s unique combination of signal characteristics – easy to identify, resistant to noise and reflection – makes it the best choice for measuring distance and addressing a wide variety of use cases.

4 Standards and Interoperability

The marketplace is at an inflection point where a broad set of established companies are designing and building products and services utilizing UWB technology. As UWB technology makes the transition to mass scale usage, success depends on an interoperable, holistic, and interconnected ecosystem. History tells us that whatever a technology’s capabilities may be, no technology reaches broad market acceptance without effective industry support.

From a standardization perspective, UWB previously served essentially as a technology for high data-rate communication and as such was in direct competition with Wi-Fi. More recently, UWB has evolved to unlock new unique and valuable capabilities, including:

- Evolving from an OFDM9-based data communication to an impulse radio technology specified in IEEE 802.15.4a (2ns pulse width); and

- Becoming a unique and secure fine ranging technology based on a security extension currently being specified in IEEE 802.15.4z (at the PHY/MAC level).

Moving from data communication to secure fine ranging allows the spatial context capability to be utilized by a variety of applications, including hands-free access control, location-based services, and device-to-device (peerto-peer) services.

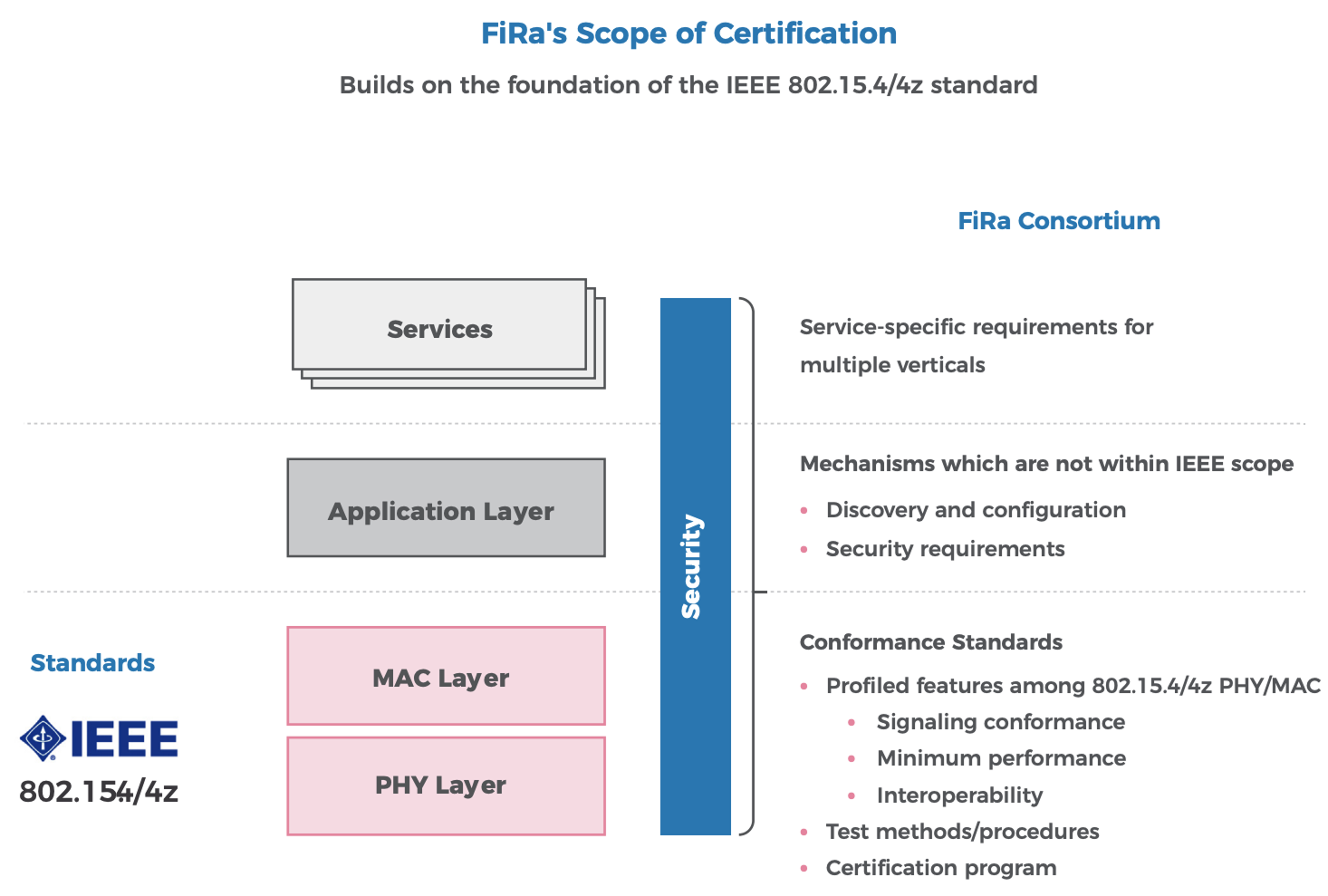

Today, the starting point for UWB technology is the IEEE standard 802.15.4 and the IEEE 802.15.4z-2020 Amendment 1. Amendment 1 is the IEEE standard for low-rate wireless networks that covers enhanced ultrawideband (UWB) physical layers (PHYs) and associated ranging techniques. The 802.15.4 standard is widely used in a variety of applications that use ranging capabilities, such as High Rate PHY (HRP) and Low Rate PHY (LRP). In general, the IEEE 802.15.4 standard defines the PHY, MAC10, and sublayers, with a focus on low-data-rate wireless connectivity and precision ranging. Different PHYs are defined for devices operating in various licensefree brands in various geographic regions.

In January 2018, as a response to demand for enhanced operation, the IEEE 802.15.4z task group was established to define the PHY and MAC layers for HRP and LRP. IEEE 802.15.4z is focused on additional coding and preamble options. This task force is also working on improvements to existing modulations to increase the integrity and accuracy of ranging measurements, with a typical range of up to 200 meters for the radio. Definition of an element that supports additional information will facilitate the exchange of ranging information.

The FiRa Consortium aims to build on what the IEEE has already established for HRP and is doing so with a broad spectrum of players. That means supporting the IEEE’s work with an interoperable HRP standard that includes performance requirements, test methods and procedures, and a certification program based on the IEEE’s profiled features. It also means defining mechanisms that are out of scope of the IEEE standard, including an application layer, which discovers UWB devices and services and configures them in an interoperable manner. FiRa is also pursuing other activities, such as developing service-specific protocols for multiple verticals and defining the necessary parameters for a range of applications. These include physical access control, locationbased services, device-to-device (peer-to-peer) services, and many more.

In addition to standards, the FiRa Consortium believes that there are three core elements required to enable broad adoption of secured fine ranging and positioning UWB technology:

- Support for the development of compelling use cases across broad business domains

– Industry leaders and innovators must work together to develop compelling use cases based on IEEE 802.15.4z UWB secure fine ranging technologies. By identifying, defining, and demonstrating the use of “Spatial Context” through new, innovative applications, UWB technology becomes relevant to end users and gives developers powerful reasons to embrace it. - Defining specifications and certifying products to enable interoperability

– When technology-driven solutions work together, without restrictions or hassles, everyone has a better and safer experience. Industry must work together to develop specifications and certification programs to support interoperability among chipsets, devices, and solutions. - Fostering a robust UWB ecosystem to enable rapid technology deployment

– Technologies only endure when they are backed by strong, quality-driven infrastructure that enables rapid expansion.

Interoperability and standardization of UWB technology enables mobile devices to be used for applications such as smart home control, access control, and indoor navigation. It will also support new solutions working with older solutions and vice versa, allowing devices and use cases to be future-proofed. Industry consortiums such as FiRa and organizations such as IEEE support interoperability of devices through standardization.

5 UWB Use Cases and Applications

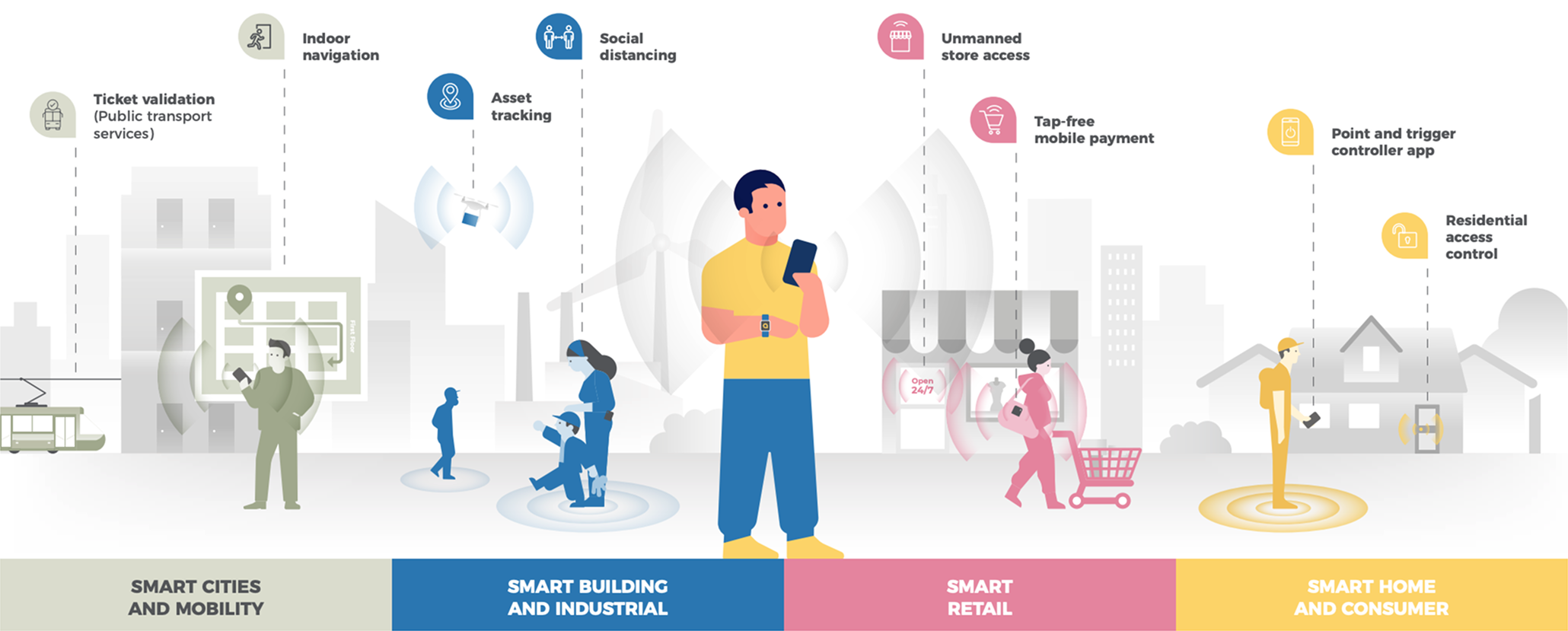

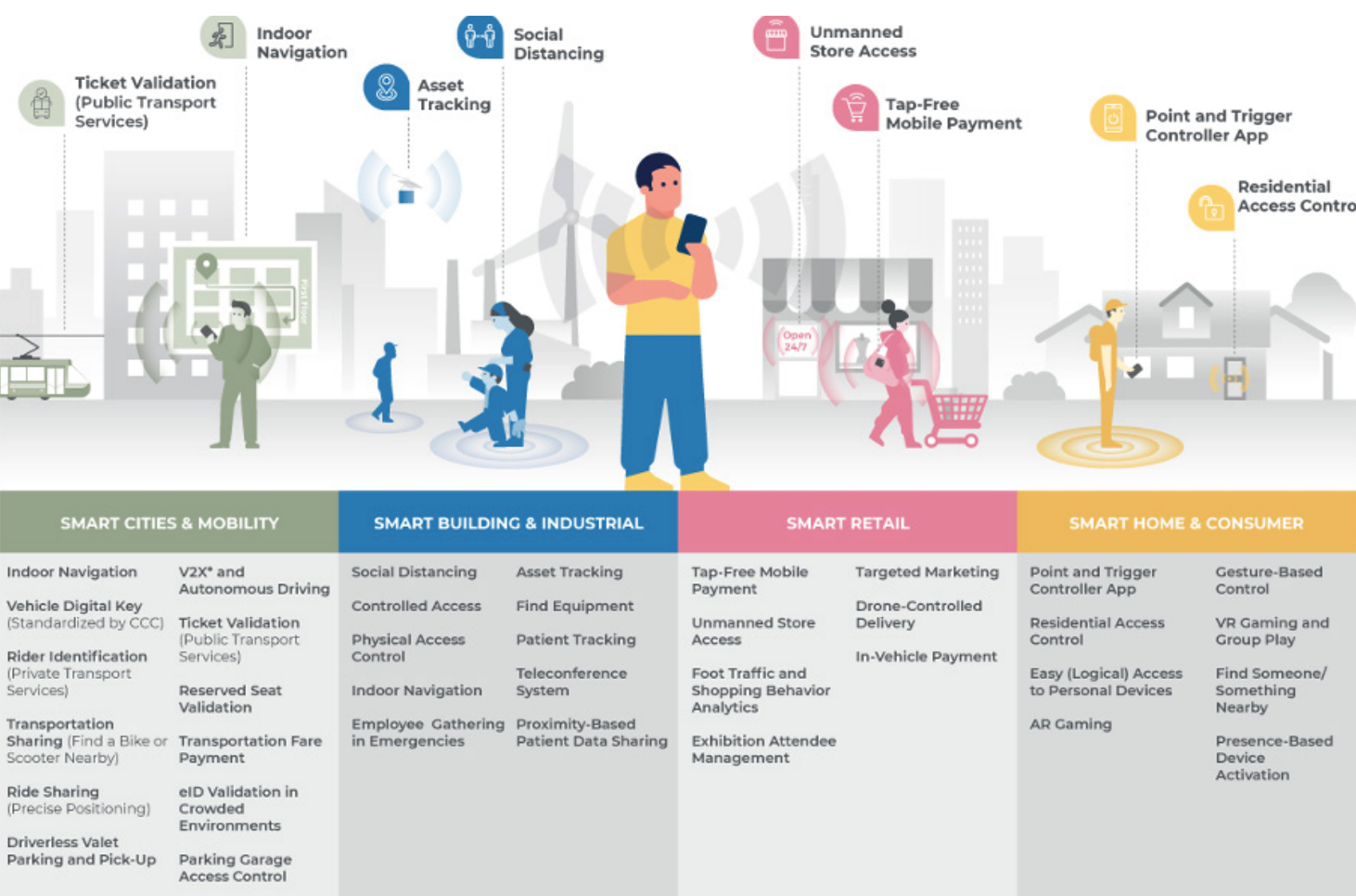

FiRa has identified a wide variety of use cases for UWB across four (4) primary market segments:

Specific use cases within each of these primary market segments are shown in Figure 3.

Initial areas of focus for FiRa include Internet of Things (IoT), secure access, tracking, and navigation. UWB was initially used primarily in professional settings, but the addition of the secure fine ranging feature has already led to adoption in mass market consumer products including devices such as digital car keys and smartphones.

Select use cases detailed below include Access Control, Real-Time Location Systems (RTLS), Personal and Consumer Device Tracking, and Smart Homes.

5.1 Access Control

It is natural to extend the use of UWB for digital car keys in the automotive space (as specified by the Car Connectivity Consortium) to the use of UWB for residential and/or commercial access control. Embedding UWB within door locks and access control readers has the potential to improve security, enable better user experiences, and provide innovative advanced provisioning capabilities. Much like in the automotive realm, enduser devices such as smartphones, wearables, key fobs, or badges can be UWB-enabled to act as digital keys.

A typical deployment scenario will involve a Bluetooth Low Energy, UWB, and Near-Field Communications (NFC) enabled reader and smartphone. Initially the devices communicate via Bluetooth Low Energy for wake up, initialization and authentication, then hand over to UWB for secure ranging to measure distance and Angle-ofArrival (AoA), and then trigger the unlock sequence as defined by a predetermined distance. NFC can act as a backup technology for battery drained mobile devices, ensuring users always have uninterrupted access.

There are several advantages of leveraging UWB for access control:

- UWB offers protection from relay station attacks which makes it well suited to secure access applications versus alternative wireless technologies.

- UWB can also detect if the user is inside or outside the building, as well as if they are walking to or from an entrance or exit. This ensures that the door is only opened when needed and prevents unauthorized access.

- Multi-session support also helps to prevent tailgating and ensuring that doors re-lock after the user has gained access, preventing others from following and thus gaining unauthorized access.

As UWB can track the user’s exact location in relation to the entrance or exit, this removes the need to perform an action such as entering a code, using a fingerprint or facial recognition system, tapping a key fob on a reader, or using a key. This alleviates potential privacy concerns with alternative methods of authentication, reduces the time it takes to perform the task, and improves the user experience. There is clear momentum for UWB-enabled access control solutions:

- As the leading global providers of physical access control and related systems, industry leaders Allegion, dormakaba, Elatec, HID Global, Kastle Systems, and Legic, among others, have joined FiRa, demonstrating their support for the use of UWB in access control. These well-known companies, due to the size and breadth of their respective offerings, are the players who set the standards in the industry that others generally then follow.

- HID Global, NXP, and Samsung showcased handsfree access control at CES 2020.

- In October 2020 Xiaomi demonstrated the concept of access control from the pocket along with its intent to support UWB in its mobile, smart home, and access devices in the future.

From a UWB technology implementation perspective, the FiRa Consortium Technical Working Group (TWG) is working towards the standardization of access control use cases. This will help to facilitate mobile devices from various OEMs, opening locks and readers from different OEMs. It will also allow different devices to seamlessly transfer access control keys between them. (This is enabled by access control hardware being configured with the proper authentication keys and encryption mechanisms to support the use of credentials from multiple brands of OEM devices.)

The growing presence of UWB within the automotive keyless entry realm will act as a catalyst and proofof-concept to wider residential and commercial deployments of digital keys. The wider adoption of UWB in mobile devices for a variety of IoT use cases will also lead to a greater installed base of digital keys. To learn more about the use of UWB in access control in commercial deployments, please view the FiRa Presents video.

5.2 Real-Time Location Services (RTLS)

Until recently, UWB was perhaps best known for its deployment within a number of RTLS applications. RTLS deployments can precisely track assets and personnel, enabling enterprises to save billions of dollars in terms of enhanced operational efficiencies, increased worker safety and compliance, and loss prevention. In most deployments, enterprises can take advantage of multiple use cases to compound ROI and other benefits.

For example, within healthcare environments, RTLS solutions can track available beds to understand and maximize utilization, trace valuable equipment to prevent theft or losses, monitor staff for hygiene compliance purposes, track patients and staff location for safety purposes, and ensure that personnel are able to access necessary areas and equipment at all times. Recently, RTLS has been deployed for social distancing, contact tracing, and cleaning enforcement applications, helping to minimize the risk of infection spreading.

UWB technology has witnessed considerable RTLS deployment growth in recent years. Various assets have UWB tags attached to them. These tags communicate with anchors deployed around the factory, warehouse, or healthcare environment, allowing items to be precisely located in real-time. UWB’s ability to deliver centimeter level location accuracy, ultra-low latency, and robustness in harsh environments gives it significant advantage over alternative technologies. This has enabled it to build success in many commercial environments for some of the more stringent asset and vehicle tracking applications. These applications include vehicle navigation and collision detection, high-value tool and equipment tracking, and worker safety applications.

A new use case for the technology, spurred by the COVID-19 pandemic, is social distancing enforcement and contact tracing. UWB RTLS providers such as Kinexon, Quarion, TSINGOAL, and others have deployed COVID-19 response solutions.

For example, Kinexon launched its SafeZone and SafeTagTM solution, a wrist-worn UWB device that enables visual warnings if the distance between workers falls below a certain threshold. Thanks to its high accuracy, the solution was deployed by the NFL and the NBA throughout 2020 to monitor social distancing and contact tracing within their bubbles. This helped ensure that their sporting seasons could continue.

By 2025, ABI Research anticipates there will be nearly 30,000 UWB RTLS deployments, backed by numerous UWB RTLS vendors including Siemens, Sewio, Kinexon, TSINGOAL, Zebra, Redpoint Positioning, Ubisense, Eliko, Pozyx, UWINLOC, Litum, Intranav, Quarion, and Tracktio, among others.

5.3 Personal and Consumer Device Tracking

More recently, thanks to UWB’s addition into several flagship smartphones, UWB is also being positioned as a personal item tracking technology for consumer applications. Smartphones with UWB are capable of locating items such as keys, wallets, backpacks, luggage, and other personal items with a UWB-enabled tag attached to them. While Bluetooth Low Energy solutions have historically dominated this space, UWB is being positioned as a differentiator thanks to its ability to provide more accurate, directional, and low latency positioning. This can help to enable enhanced user tracking experiences such as augmented reality finding. As used within other UWB applications, Bluetooth Low Energy is being leveraged in conjunction with UWB in these personal trackers for initial pairing and handover.

In April 2021, Apple unveiled its AirTag solution which contains UWB, Bluetooth Low Energy and NFC technology. For iPhones™ without UWB capabilities, users can use Bluetooth Low Energy to find their devices. However, for those devices equipped with UWB, users can more accurately locate their lost items through “Precision Finding”, which will guide them to their AirTag using sound, haptics, and visual feedback. Lost AirTags can be tapped by an NFC-enabled device to bring up contact details of the tag owner.

In April 2021, Samsung officially launched its Galaxy SmartTag+ tracker. Combining UWB and Bluetooth Low Energy, the SmartTag+ enables AR Finding as part of its SmartThings Find service. Users are visually guided to their lost device using their smartphone’s camera, making it much easier to precisely locate their items, improving the finding experience for end users. Users can tag items as missing and other Galaxy device owners can help to locate lost items as part of a crowdsourced network. This could also help to create new services for mobile operators and insurance companies, leading to new business models and additional value for end users.

ABI Research expects annual shipments of UWB-enabled personal trackers to grow to 34 million by 2025, as the installed base of UWB-enabled smartphones increases. In the longer term, as UWB’s installed base develops and technology matures further, ABI Research anticipates that many device manufacturers will start to embed the technology directly within devices. For example, small or frequently misplaced items such as true wireless earbuds equipped with Bluetooth Low Energy for audio could also leverage UWB for item finding.

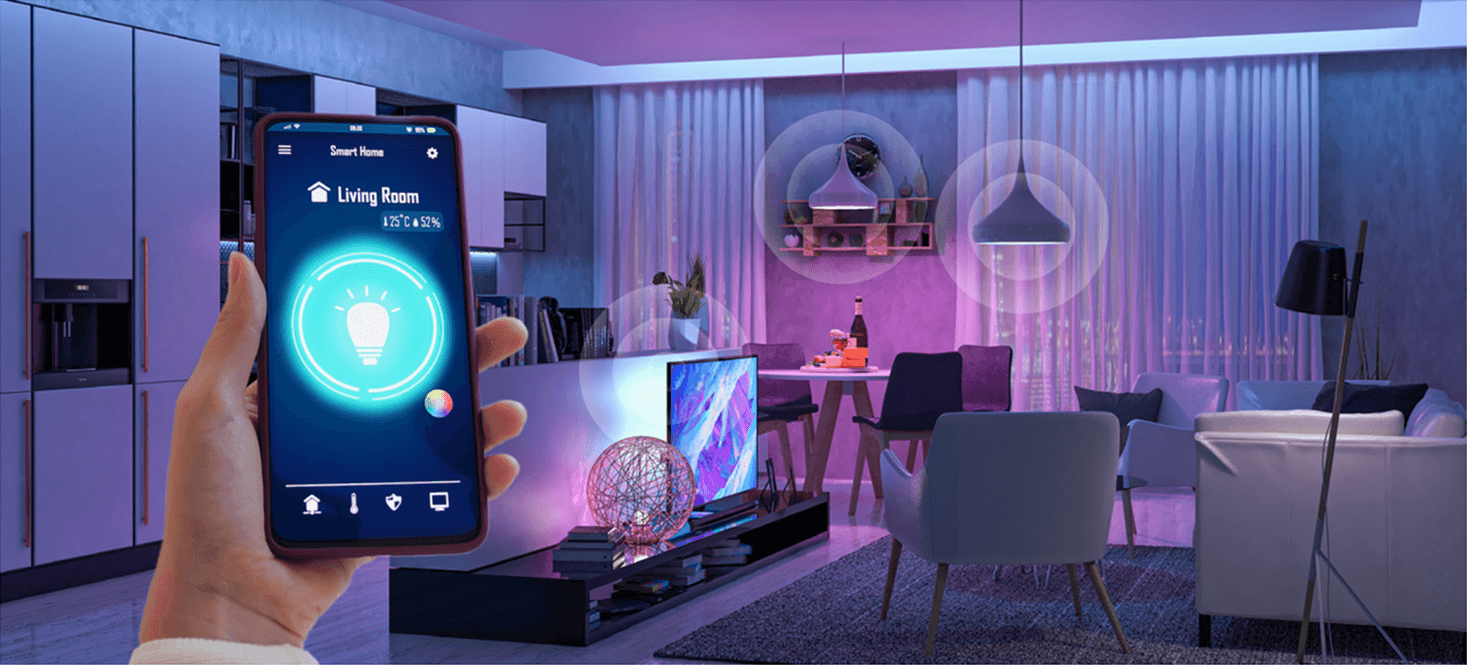

5.4 UWB in The Smart Home

The vision of a fully automated, truly intelligent, highly personalized, and interconnected smart home has not yet been fully realized. A large part of this has been due to the absence of highly accurate indoor location technologies that are capable of enabling the smart home platform to determine precisely who and where someone is, as well as their intention. The next wave of the smart home’s evolution will come from the combination of seamless connectivity and interoperability between devices, alongside the precise localization of people and objects within the home. Thanks to its ability to precisely pinpoint the distance and direction between different UWBenabled products within the home environment, UWB has the potential to enable this seamless, automated, and personalized experience within the home. This will allow for better end-user interaction experiences as well as more intelligent automated homes that rely less on manual interaction and can adapt in real time to the specific needs for end-users. There are two major ways in which UWB can help to achieve this: (1) point-and-trigger control; and (2) presence detection and follow-me.

5.4.1 Point-and-Trigger Control

As the name suggests, point-and-trigger applications involve pointing a UWB-enabled smartphone towards other UWB-enabled connected home devices such as speakers, televisions, light bulbs, thermostats, or other appliances. Based on UWB’s high accuracy and directional capabilities, the smartphone can detect exactly what device it is being pointed at, and automatically open a relevant control panel on the smartphone display. This can then be utilized to turn a television on or off, select the color and brightness of a smart light bulb, change the radio station or song, adjust the volume on a speaker, turn up the thermostat, or seamlessly cast video and audio to a television or speaker. In addition to control panels, smartphones could also pull up additional contextual information, such as song lyrics, further recommendations, and other new ways of engagement. This could help drive valuable new entertainment services within the home.

While voice control is optimal for more simple tasks that are easy to describe (e.g., playing a specific song on a speaker), for certain home automation and control tasks, describing what is required can be a lot more cumbersome. For example, selecting a specific light bulb in a room and changing it to the correct color and brightness is much easier to control via a dedicated app and touchscreen control than voice.

However, the process for this control today is not seamless. Users have to unlock their smartphone, open up the correct app, select the correct device and manually adjust the settings. With UWB, this problem can be alleviated, providing a much more desirable one-tap user experience. Xiaomi recently demonstrated UWB being leveraged within a variety of smart home devices such as fans, lamps, and smart speakers. This demonstration highlights the growing potential of the UWB-enabled smart home ecosystem. Similarly, Apple has already incorporated UWB within its HomePod mini® smart speaker. The HomePod mini was recently updated to allow streamlined handoff of content such as music, calls, and podcasts with iPhone® devices. By leveraging UWB, the device is able to add visual and haptic feedback and provide listening suggestions when the iPhone is in close proximity to the speaker. It can also display controls on the device without needing to unlock it.

5.4.2 Presence Detection and Follow-Me

By embedding UWB within smart home devices, they can respond to specific user movements automatically. Examples of this include turning on a light, playing a preferred playlist, or adjusting to the preferred temperature when a user enters or leaves a room, and can follow them from room to room. Personal profiles could be set up for homes with multiple occupants, enabling certain smart home devices to adjust to their own unique preferences.

UWB can determine that the end user is within a specific room, or even in a more specific location, enabling more contextual interaction. For example, when a user is sitting on the sofa, the television could automatically switch on and return to what the user was previously watching or dim the lights to the preferred settings. UWB embedded within a notebook PC could detect when the user is sitting at the desk and securely lock or unlock the device as required, preventing any intrusion.

As highlighted earlier, many smart home and building security vendors are members of the FiRa Consortium and have promoted the potential of UWB for secure hands-free access control within both residential and commercial environments. The low latency of UWB ensures a seamless and immediate experience. Users won’t be frustrated while waiting for the lights to turn on or pointing to a device that takes a long time to open up the correct control panel.

6 The UWB Market is Dynamic and Growing Rapidly!

Compelling new experiences benefiting users, combined with the development of an open and interoperable ecosystem, is driving rapid and widespread adoption of UWB across multiple markets and applications.

The marketplace is at an inflection point where a broad set of established companies are designing and building products and services utilizing UWB technology. As validated by industry analysts, FCC product approvals, Consumer Electronics self-declarations, and a variety of published case studies, UWB technology is in the early stages of making the transition from niche applications to mass scale usage.

As validated by FCC product approvals, according to information on the FCC website, there were 85 UWBenabled products granted FCC certification in 2021. The FiRa Consortium believes that a change in the current FCC regulations regarding the use of UWB technology will drive significant growth in the number of UWBenabled products that are approved.

As highlighted by MarketsandMarketsTM, major factors driving growth in the UWB market are:

- Increased growth in deployment of UWB technology in devices (i.e., mobile phones)

- Increased adoption in the consumer Internet of Things (IoT) and the Industrial Internet of Things (IIoT)

- The rising demand for UWB technology in Real-Time Location Systems (RTLS) applications

6.1 Increased Deployment of UWB Technology in Devices

UWB is currently being adopted in flagship smartphones to enable secure access and context-based user interfaces. In 2021, UWB has been adopted in over 300 million smartphones, representing an attach rate of approximately 20%. In the next five (5) to ten (10) years, it is anticipated that UWB will be gradually adopted across all smartphones, representing a market potential of 1.5 billion devices per year.

And as noted by MarketsandMarkets, a driver in the increased use of UWB technology will be the availability of UWB-enabled devices. According to ABI Research, and as shown in Figure 4 below, the total of all UWBenabled devices shipped globally will grow from 109 million devices in 2019 to over 1 billion devices by 2025. In total, 3.6 billion UWB enabled devices will be shipped globally by 2025. In fact, the UWB market is projected to grow by double digit percentages for the foreseeable future18.

In addition to the inclusion of UWB in smartphones, we are already seeing the early adoption of UWB in smart watches. As is the case with smartphones, the initial use cases will enable secure access and context-based user interfaces. Based on available data, 150 million smart watches will be in market by 2025; the UWB attach rate in 2021 was approximately 20%.

Adoption of UWB technology in smartphones and smart watches will ultimately enable a multitude of use cases; this will drive adoption of UWB in the following areas over the next three (3) to ten (10) years:

- The “connected home” is believed to offer great benefit to residents of these homes. According to Verified Market Research, the global smart speaker market size was valued at $6.42 billion in 2020 and is projected to reach $61.87 billion by 2020, gorwing at a CAGR of 32.75% from 2021 to 2028.19 Based on this data, FiRa estimates that adoption of UWB has started in the smart speaker market with an attach rate of approximately 5% in 2021. Also significant within the “connected home” is the television market where UWB point-andcontrol and presence detection capability enables new forms of user interfaces. According to data compiled from FiRa members, this market represents a total available market size of 250 million devices. If you consider remote controls that work with these devices, this number doubles to 500 million devices.

- The growth of UWB-enabled tags to locate personal assets is fueled by providers such as Apple, Samsung and Tile, all of whom have already adopted UWB for this use case. Based on data provided by various FiRa member companies, the total available market for UWB-enabled tags is expcted to be 150 million units by 2025.

- Another fast-growing area of UWB adoption is presence detection and security in high-end laptops and other hardware (PC, Chromebooks™, etc.). FiRa members estimate that the total available market will be approximately 300 million devices by 2025.

- As noted elsewhere in this report, the use of UWB in consumer and enterprise access points is also exploding. UWB has already been adopted in industrial applications to deliver location and navigation services and in an initial consumer Wi-Fi Access Point. It is expected that consumer and enterprise access points will represent a total available market of more than 200 million devices by 2025.

It should be noted that this number does not include the “beacon”20 market which is projected to grow at a 37% CAGR in the next ten years, representing more than $100 billion market by 2030. Today the “beacon” market is largely dominated by the use of Bluetooth and/or Wi-Fi. Thanks to its superior location capabilities, FiRa members expect that UWB will experience significant growth in this market, taking advantage of the overall high growth rates.

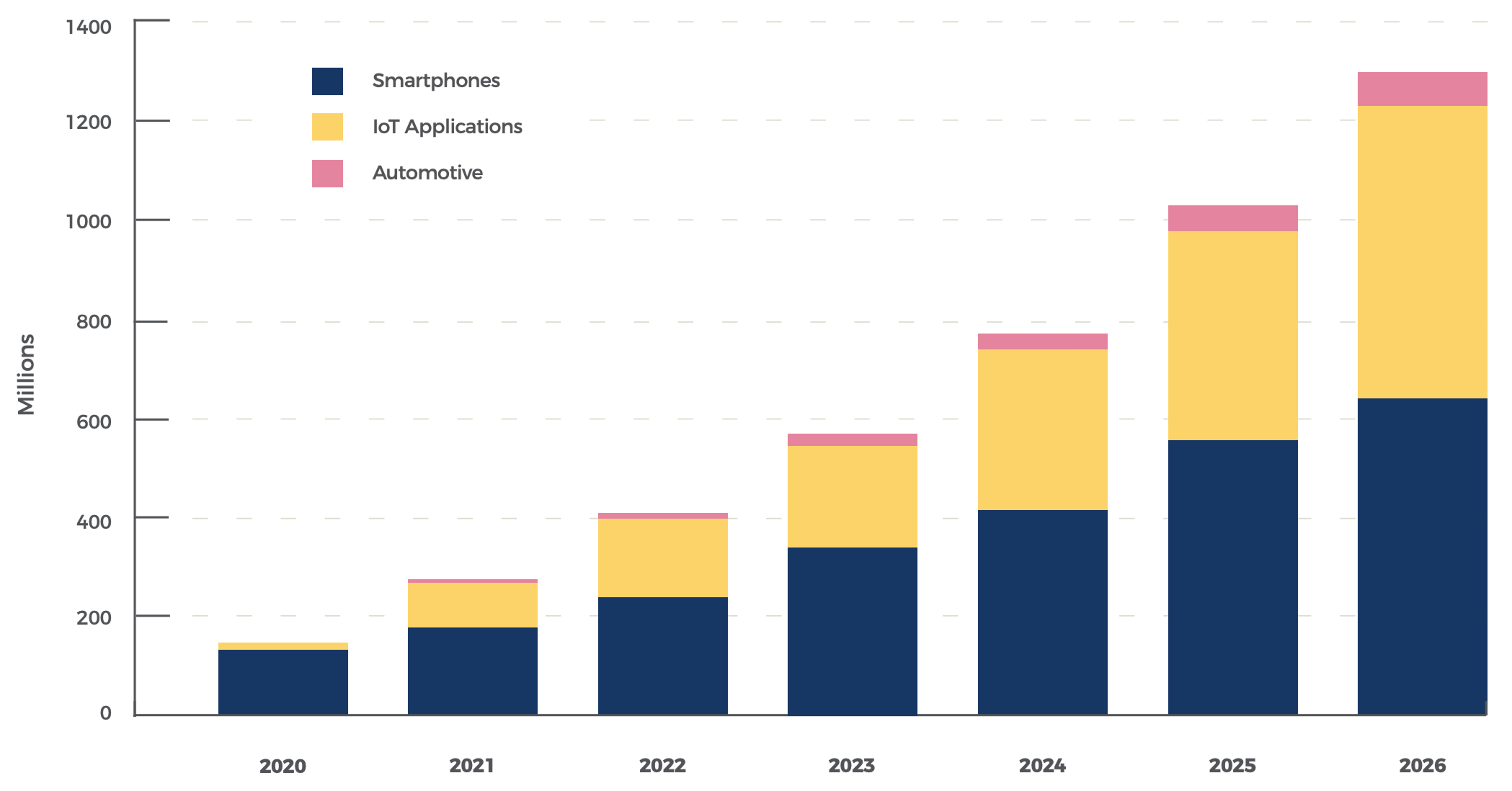

One data point that supports the expected growth of UWB is from ABI Research. The Figure 5 graph shows UWB-enabled device shipments by market segment from 2020 to 2026.

As the US is a key market, it is expected that 100% of consumer device manufacturers will seek FCC approval for their UWB-enabled devices. In 2021 alone, there were 85 devices certified by the FCC. As uses for UWB technology proliferates, there will be a positive economic impact as more developers and manufacturers seek FCC approval and begin selling their products into the US market.

6.2 Internet of Things (IOT) in Industrial and Consumer Markets

The second area of focus by MarketsandMarkets is the Internet of Things (IOT) in both the consumer and industrial spaces. Oracle notes that “the Internet of Things (IoT) describes the network of physical objects – “things” – that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the internet. These devices range from ordinary household objects to sophisticated industrial tools. With more than 7 billion connected iOT devices today, experts are expecting this number to grow to 10 billion by 2020 and 22 billion by 2025”.

Oracle further notes that “over the past few years, IoT has become one of the most important technologies of the 21st century. Now that we can connect everyday objects – kitchen appliances, cars, thermostats, baby monitors – to the internet via embedded devices, seamless communication is possible between people, processes, and things

According to Verified Market Research, “the IoT market size was valued at USD 1186.20 Million in 2021 and is projected to reach USD 6075.70 Million by 2030, growing at a CAGR of 19.91% from 2022 to 2030.

Verified Market Research goes on to note that “the development of wireless networking technologies will lead to a larger base of individuals interested in purchasing IoT devices. This is the crucial aspect in the rise in the market revenue of the Internet of Things (IoT)23. Also fostering market growth will be the growing use of third-party platforms, incremental growth in digital transformation, and the use of IoT in manufacturing.

Based on its fine ranging capability, UWB technology is enabling large numbers of IoT applications and use cases. One large category of applications is access control including digital car keys in the automotive space and UWB-enabled door locks and readers used in commercial and residential markets. Another set of UWB IoT applications include Personal and Consumer Device Tracking, such as tracking and locating keys, wallets, and other personal items with a UWB tag attached to them. Furthermore, UWB is enabling many smart home IoT applications by providing highly accurate indoor location information to UWB enabled smart home devices, such as point-and-trigger controllers and presence detection devices.

6.3 Real-Time Location Systems (RTLS) Applications

The third area of focus by MarketsandMarkets is the rising demand for UWB technology in Real-Time Location Systems (RTLS) applications. In a report from August 2021, MarketsandMarkets estimated that the global indoor location market will grow from about $7 billion this year to $19.7 billion by 2026, a CAGR of nearly 23%. According to this report, the fastest growing indoor location services will be in the APAC region. The report says this is due to “increasing demand for indoor positioning technologies across manufacturing, retail, and transportation and logistics verticals across APAC countries”. The report also noted that companies are using indoor location technology for facility management, virus tracking, people tracking and management, and smart quarantining.

Other market research provides similar data on the indoor location system market. For example:

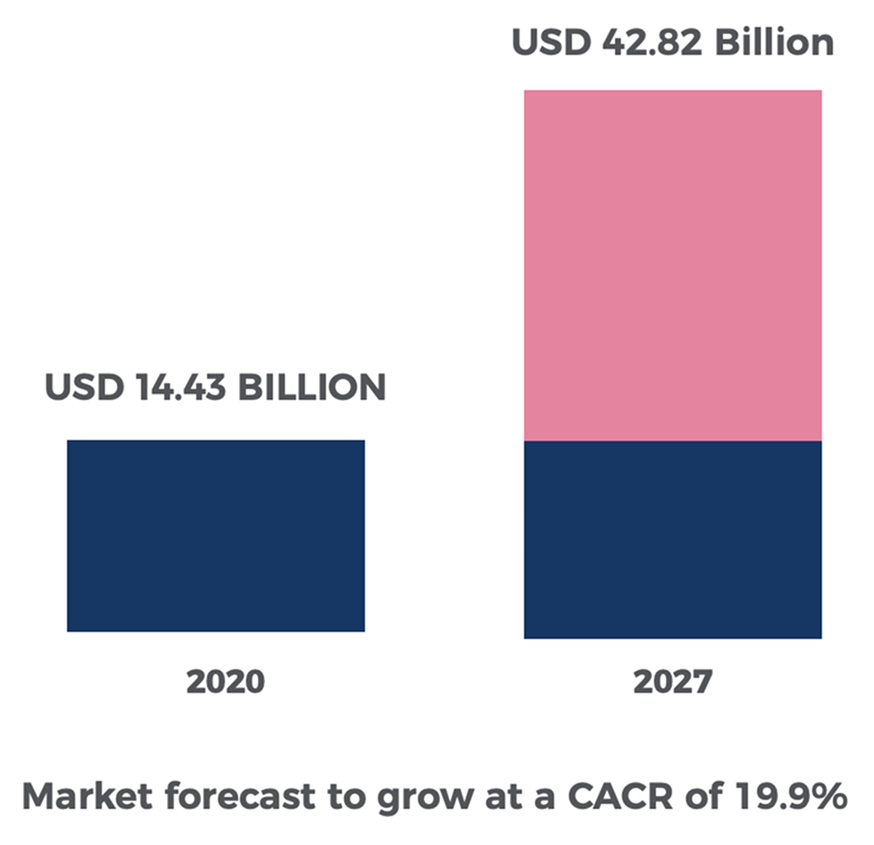

- • As shown in Figure 6, the report from Research and Markets indicated that the global indoor location-based services market size was estimated at USD 12.08 billion in 2020 and was expected to reach USD 14.43 billion in 2021, at a CAGR of 19.80% to reach USD 42.82 billion by 2027.

- Mordor Intelligence predicts that the indoor location market is expected to register a CAGR of 21.7% over the forecast period 2021 to 2026. Further, Mordor Intelligence expects that North America will hold the highest market share during the forecast period. This is due to the growing smartphone penetration and the growth of IoT technology in the area. Other factors favoring the growth of indoor location services in North America include the growing investment in the development of different technologies and the use of indoor location solutions.

6.4 Regulatory Changes Positively Impact the Consumer Experience

As we examine the fast-paced growth projected by market studies for UWB technology, it should be noted that these figures do not account for the positive impact of regulatory adjustments requested for implementation by the FCC. The FiRa Consortium maintains that implementation of requested regulatory changes will contribute to accelerating the development and adoption of UWB-enabled devices and the time is ripe to do so now. Such regulatory changes will support use cases that are either not possible or are a stretch under the current rules. Additionally, regulatory changes will greatly enhance and/or improve the consumer experience associated with existing use cases, further driving adoption of the technology and our understanding of its safe and effective use.

As more UWB-enabled mobile devices are coming to market, end-users are beginning to have the opportunity to experience the power that UWB places in their hands. The brand power and reach of the mobile OEMs, many of whom are members of the FiRa Consortium, will play a large role in educating consumers and will drive demand for UWB-enabled mobile devices. This will, in turn, trigger demand for increased interactions between mobile and IoT devices, particularly in the home over the near-term. Consumers will demand that the ecosystem continues to develop as they see that UWB can make their home life more convenient and secure.

As people become more familiar with the technology and build trust in its use, new habits will be formed that rely on the use of UWB. This will drive expectations for a higher penetration of UWB technology in all types of consumer and commercial devices. In turn, the smart city infrastructure will have to adapt to new device capabilities to deliver a more seamless response to user’s needs.

The (r)evolution has started and UWB will soon be at the heart of our daily lives!

7 Regulatory Challenges

7.1 Historical Perspective on Current UWB Spectrum Rules

One of the major challenges with UWB is that it transmits over a wide frequency band; therefore, in the absence of appropriate regulations, there is the potential for interference with other wireless systems and/or incumbents that share the same frequencies27. To avoid such interference, many countries set strict rules on the maximum transmitter power and limit the use environments (including frequency bands and locations) in which UWB is permitted to transmit.

In 2002, the Federal Communications Commission (FCC) in the United States opened the spectrum for ultrawideband applications from 3.1 GHz – 10.6 GHz.

The existing 20-year-old regulations were developed at a time that did not and could not have contemplated the capabilities being developed now and consequently have shortcomings that have been highlighted in working with UWB technology in real-world use cases. Additionally, the UWB application focus has shifted. For instance, the original rules from 2002 envisaged use of UWB for high and ultra-high bandwidth data communications using OFDM modulation. However, today, popular low activity factor ranging and localization applications use impulse-based modulation.

7.2 Outdoor Applications for Access Control and Real-Time Location Services (RTLS)

Access control and RTLS are highly valuable both indoors and outdoors. By nature, these include stations in a fixed location (e.g., as an access control terminal such as a door lock, a payment terminal, etc.) or as a localization reference anchor.

Current FCC rules do not permit fixed position outdoor UWB stations. This lack of permission for fixed outdoor UWB stations (e.g., door locks) significantly hampers the rollout of seamless access control and RTLS applications. Although manufacturers can seek required approvals via the FCC waiver process, this is expensive and time consuming for the manufacturers and ultimately impedes broader adoption of the technology. The waiver process is also not sustainable for the FCC as the number of waiver requests will continue to increase. Appropriate rule changes will enable and support the widespread adoption of UWB technology that is on the immediate horizon.

It should also be noted that the current rules also create a rift with respect to the indoor and automotive deployment of what is, in many cases, the same application.

Additionally, ambiguity arises from the interpretation of “hand-held systems” which are permitted to operate outdoors as currently defined under the FCC UWB rules. RFID tags, RFID tag readers, car key fobs, etc., are examples of devices with potentially ambiguous qualification under current FCC rules.

In summary, a seamless regulation for the use of UWB for access control and RTLS, including outdoor applications, is urgently needed.

7.3 Vehicular Applications

Current FCC rules permit some vehicle-based applications to qualify as hand-held systems. This non-intuitive interpretation should be clarified or alternatively, the rule should be amended to directly reflect authorized vehicular uses. Flexible connections for a vehicular UWB station and its designated antenna should be permitted to facilitate more freedom in mounting antennas and electronics in vehicles. Vehicles should also be allowed to be a de facto mounting point for various types of UWB applications.

7.4 Deployment Flexibility for Real-Time Location Services (RTLS), Smart Home Point-andTrigger Control, and Presence Detection

The complexity of the indoor radio environment in the UWB-enabled smart home offers many challenges. Indoor UWB transmission and reception is often impaired by obstacles, placement of UWB stations is subject to non-UWB related application constraints, and for on-body applications, there can be significant signal attenuation due to body-loss. Less restrictive power limits indoors will enable substantially more robust deployment of applications like RTLS, Smart Home Point-and-Trigger Control, Virtual Reality and Gaming, and Presence Detection while still protecting other spectrum uses outdoors.

7.5 Ensuring Future Access to Spectrum

7.5.1 A “Safe Harbor” Band to Permit Enduring Deployment of Access Control and Real-Time Location Services (RTLS) Applications

UWB services have no protection from interference by other spectrum users. Recently some professionally operated UWB services have started to relocate to another frequency band due to the deployment of newly permitted 6 GHz Wi-Fi systems. Deployment of Wi-Fi, cellular and other systems deploying many local transmitters using higher power than UWB can locally and temporarily “drown out” UWB applications, thus making UWB services unreliable.

Access control and RTLS applications require a very high level of reliability as they have to be highly secure and provide trustworthy data for process automation. It is paramount to have a band where such applications can be deployed with confidence (i.e., without there being a risk that higher volume, higher power systems are deployed in the same band in the foreseeable future). Such a band could be nominated as a “safe harbor” band for UWB services. A candidate for such a “safe harbor” band could be a band that lends itself poorly to deployment of other higher power local transmitter-based applications. Thus, FiRa prefers UWB "Channel 9”29; however, FiRa is also willing to adapt to other available channels.

7.5.2 Expanded Spectrum for New Applications

For a set of UWB applications, to allow higher spatial resolutions, more robust data communication capabilities and/or interference mitigation operation to ensure proper operation of the UWB systems, a significantly broader bandwidth would be required. These applications include: (1) sensing and tracking applications that will only be feasible when every broadband UWB signal is deployed to reach the required sensing and/or tracking precision; and (2) communications applications that require the availability of more channels to facilitate intra-device and interdevices RF coexistence.

Therefore, the FiRa Consortium suggests extending the UWB spectrum from 10.8 GHz up to 12.7 GHz.

8 References

1) Global Indoor Location Market by Component. (2021, August). Retrieved from Research and Markets: https://www.researchandmarkets.com/reports/5427261/global-indoor-locationmarket-by-component?utm_source=CI&utm;_medium=PressRelease&utm;_code=blk7wl&utm;_ campaign=1592884+-+Indoor+Location+Market+by+Component%2c+Technology%2c+Application%2 c+ Organization+Siz

2) Global-internet-of-things-iot-market-size-and-forecast. (2021). Retrieved from Verified Market Research: https://www.verifiedmarketresearch.com/product/global-internet-of-things-iot-market-size-andforecast-to-2026/

3) Hans-Juergen Pirch and Frank Leong. (2020, Feb.). Introduction to Impulse Radio UWB Seamless Access Systems. Retrieved from FiRa: https://www.firaconsortium.org/sites/default/files/2020-10/introductionto-impulse-radio-uwb-seamless-access-systems-102820.pdf

4) INDOOR LOCATION MARKET - GROWTH, TRENDS, COVID-19 IMPACT, AND FORECASTS. (n.d.). Retrieved from Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/indoor-location-market

5) Qorvo. (May 2021). Getting Back to Basics with Ultra-Wideband (UWB). Retrieved from https://www. qorvo.com/resources/d/qorvo-getting-back-to-basics-with-ultra-wideband-uwb-white-paper

6) Research and Markets. (2021). Retrieved from https://www.researchandmarkets.com/reports/4896758/ indoor-location-based-services-market-research#rela0-5427261

7) (August 2021). Ultra-Wideband (UWB) for the IoT—A Fine Ranging Revolution? ABI Research. Retrieved from https://b2b-knowhow.com/assets/6828-ultra-wideband-uwb-for-the-iot-a-fine-ranging-revolution and https://www.allaboutcircuits.com/uploads/articles/UWBWP.pdf

8) Ultra-wideband Market. (2021, Dec.). Retrieved from Allied Market Research: https://www. alliedmarketresearch.com/ultra-wideband-market-A0862

9) What is IoT. (2021). Retrieved from Oracle Corp.: https://www.oracle.com/internet-of-things/what-is-iot/